#Household expense tracker software

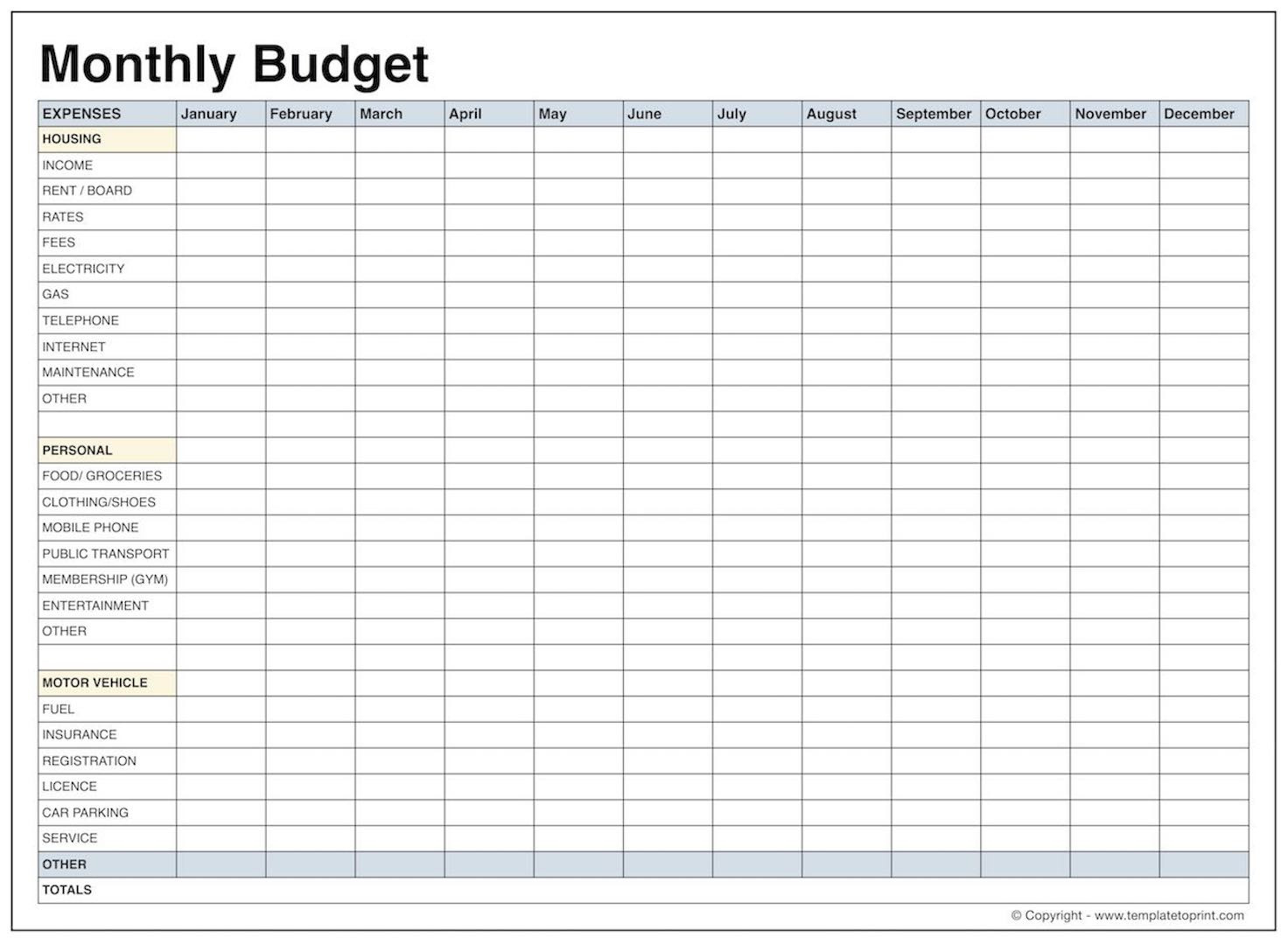

For example, for each of the utility companies to which you make a monthly payment, use your personal finance software to track your payments separately. UtilitiesĪvoid lumping together your gas, electric, water and cable TV bills as “total utilities.” It’s harder to assess your usage that way. on the 2nd of the month, you're late, regardless of whether you have a grace period. Washington, D.C.-based senior mortgage banker Steven Pearson reminds homeowners that if the mortgage payment is due on the 1st of the month, at 12:01 a.m. But he cautions consumers to always have enough money in the bank before the landlord or mortgage lender takes it out every month. Commingling your emergency fund and other savings can be a spending temptation that's difficult to resist."īecause monthly rent or mortgage payments generally are fixed, look at automatic bill-pay options for making payments, says Corprew.

"But keep it separate from your regular savings account.

"Make saving for an emergency a a priority, because you never know when you'll need it," Corprew notes. Maryland-based financial adviser Lamont Corprew, a Certified Public Accountant, is an advocate for having an household budget emergency fund.

0 kommentar(er)

0 kommentar(er)